Equinor and Sheringham Shoal, Dudgeon Extension Partners Agree Joint Ownership of Merged Projects

Equinor and its partners on the extension projects that are planned to be built next to the operational Sheringham Shoal and Dudgeon offshore wind farms in Norfolk, UK, have agreed to bring the two projects under a joint ownership structure in one legal entity.

The Dudgeon Extension Project is owned by Equinor (35 per cent), Masdar (35 per cent) and China Resources Power (30 per cent). Sheringham Shoal Extension Project is currently 100 per cent owned by Equinor, with Equitix Offshore 3 Limited (co-owned by funds managed by Equitix and The Renewables Infrastructure Group) and Macquarie Asset Management (via Macquarie GIG Renewable Energy Fund 1) having options to acquire a total of 60 per cent interests at Final Investment Decision (FID).

Joint ownership of the two projects is subject to regulatory approvals being obtained before closing.

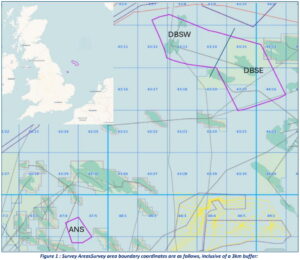

Development consent approval for the Sheringham Shoal and Dudgeon projects, granted by the UK Secretary of State for the Department of Energy Security and Net Zero in April 2024, allows for single, joint or sequential development options. This marked the first time in the UK that two offshore wind projects under separate ownership were awarded consent under a shared application that provides the opportunity to combine the development of the two projects.

Related Article

-

Equinor Secures Development Consent for UK Offshore Wind Extension Projects

Planning & Permitting

The consented application includes an option to utilise an integrated transmission system, as well as separate grid connections for each project, within the same overall onshore footprint. The projects are also planned to leverage the existing operations and maintenance base at Great Yarmouth, which will continue to serve the operational Sheringham Shoal and Dudgeon wind farms, as well as the new turbines once developed.

Equinor said on 17 December that the new joint ownership structure enabled a cost-effective development of the two projects whilst minimising environmental and local impact in Norfolk.

“Drawing on our experience of oil and gas unitisation, we have applied key learnings to make this project more competitive, ensuring economic efficiencies and cost savings. By developing one project instead of two, we can unlock additional value from volume at scale, whilst sharing joint infrastructure, maximising local benefits and minimising disruption”, said Halfdan Brustad, Equinor’s Vice President UK Renewables.

ADVERTISE ON OFFSHOREWIND.BIZ

Get in front of your target audience in one move! OffshoreWIND.biz is read by thousands of offshore wind professionals daily.

Follow offshoreWIND.biz on: